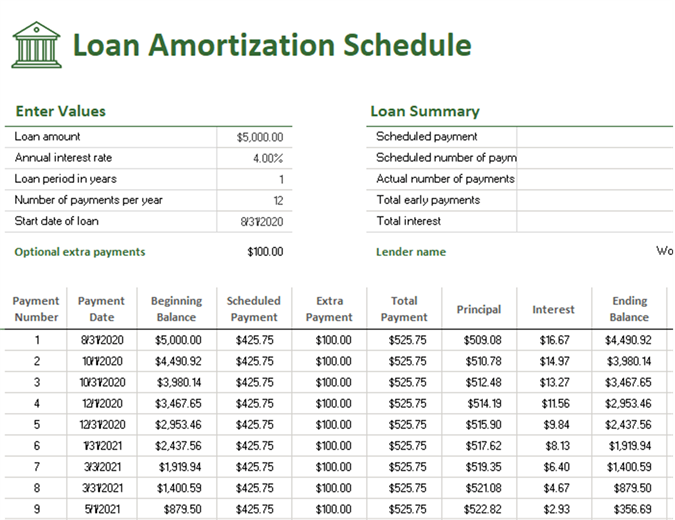

Each monthly payment is listed to the end of the loan term, when the loan will be paid off. You may also hear this referred to as a mortgage amortization schedule or mortgage amortization table. This amortization schedule includes the amount of principal and interest within each payment. What Is an Amortization Schedule?Ī table that shows periodic loan payments is referred to as an amortization schedule. Calculating how long it will take to pay off the loan with amortization can help you forecast your monthly costs.

#Amortized mortgage full#

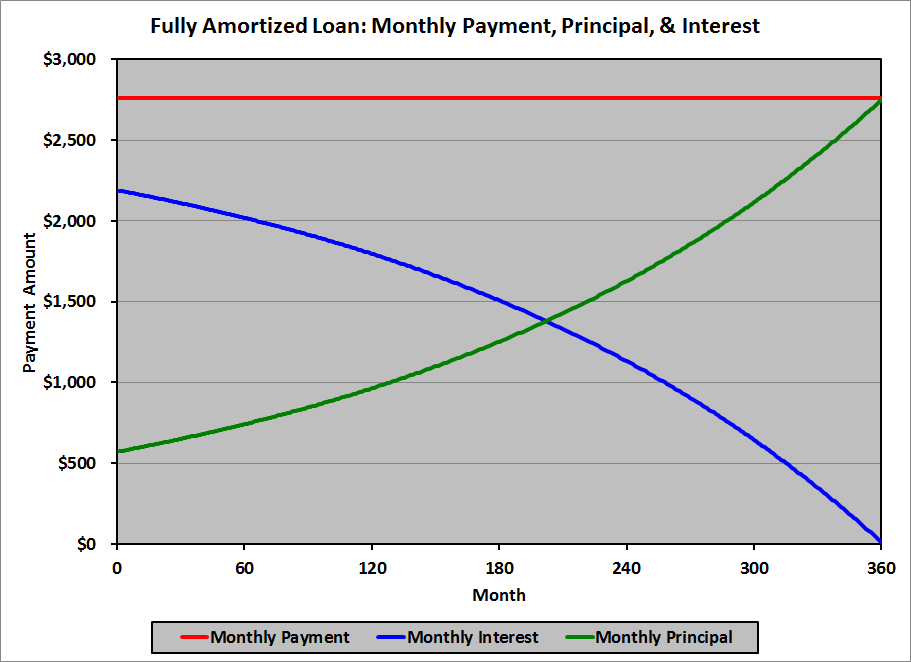

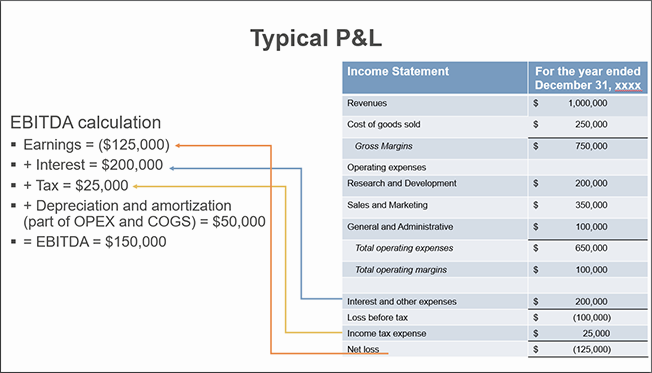

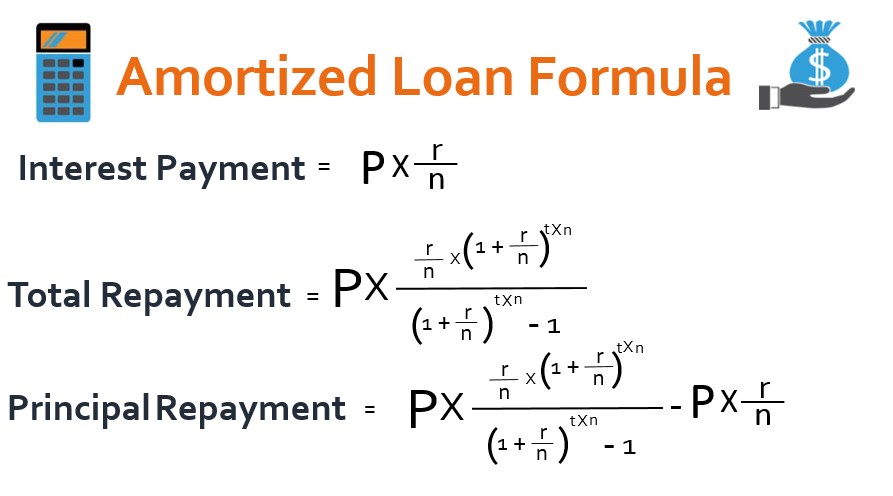

Getting a loan is much more appealing than having to save for the full price of a house or car, and amortization is the process of breaking up the loan, making it an accessible payment method. You make consistent payments on a loan, gradually lowering its total value until the loan is completely paid off. Amortization can also apply to an intangible asset, and in this case, works similarly to depreciation. This change in the ratio of interest to principal is detailed further in a loan amortization schedule.Īmortization lowers the book value of a loan by spreading regular payments out over a set period of time. You make payments in regular installments of a set amount, though the ratio of interest to principal changes over the repayment period. Interest: This portion of your payment is what you pay your lender for loaning you money.Principal: This portion of your payment goes toward reducing the balance of your loan.If you apply for any of these types of loans, don’t expect an amortization schedule. Personal loans are generally used for debt consolidation or small personal projects. Typically, personal loans are given for a term of three years at a fixed interest rate with a fixed monthly payment. Personal loan: A personal loan you can obtain from a credit union, bank or an online lender also tends to be amortized.

#Amortized mortgage drivers#

Some drivers decide whether they can afford a car based on what their fixed monthly payment will be.

Though many homeowners may not keep their mortgage that long, such as if they sell their home or refinance, the loan functions as if you are going to keep it for the entire 15-year or 30-year term.

What is loan amortization? Loan amortization is the schedule of periodic payments for a loan and gives borrowers a clear picture of what they’ll be repaying in each repayment cycle. Secure the Right Loan With Assurance Financial.What Are a Few Things to Keep In Mind About Amortization?.What Are the Amortization Schedule Uses?.

Still have questions or need more information? Below is an overview of what this article covers! The amortization schedule for a mortgage is an essential component to understanding the breakdown of your payments during the term of your mortgage. Many of the mortgage-related terms may be new to you, such as conforming loans, non-conforming loans, fixed interest rates, adjustable interest rates, and loan amortization schedules. The process of obtaining a mortgage can feel overwhelming, especially for first-time homebuyers. The last line should show the total interest you paid and your principal payments for the full term of the loan. The bulk of each payment will be the loan’s principal. Each payment should be the same per period - however, you will owe interest for the majority of the payments. The schedule shows all payments until the end of the loan term. The amortization schedule is a record of your loan payments that shows the principal amounts and the interest included in each payment.

0 kommentar(er)

0 kommentar(er)